Page 10 - Moreno Valley 2025 Citizens Guide to the Budget

P. 10

REVENUES

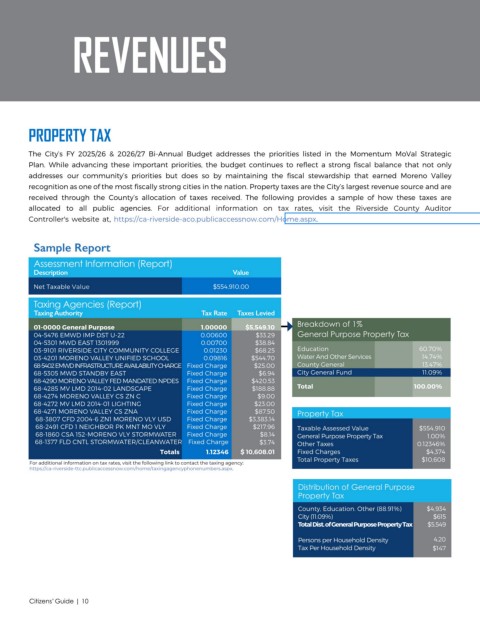

PROPERTY TAX

The City’s FY 2025/26 & 2026/27 Bi-Annual Budget addresses the priorities listed in the Momentum MoVal Strategic

Plan. While advancing these important priorities, the budget continues to reflect a strong fiscal balance that not only

addresses our community’s priorities but does so by maintaining the fiscal stewardship that earned Moreno Valley

recognition as one of the most fiscally strong cities in the nation. Property taxes are the City’s largest revenue source and are

received through the County’s allocation of taxes received. The following provides a sample of how these taxes are

allocated to all public agencies. R A

' // . . / . .

Sample Report

Assessment Information (Report)

Description Value

Net Taxable $554,910.00

Taxing Agencies (Report)

Taxing Authority Tax Rate Taxes Levied

01-0000 General Purpose 1.00000 $5,549.10 Breakdown of 1%

04-5476 EMWD IMP DST U-22 0.00600 $33.29 General Purpose Property Tax

04-5301 MWD EAST 1301999 0.00700 $38.84

03-9101 RIVERSIDE CITY COMMUNITY COLLEGE 0.01230 $68.25 Education 60.70%

03-4201 MORENO VALLEY UNIFIED SCHOOL 0.09816 $544.70 Water And Other Services 14.74%

68-5402 EMWD INFRASTRUCTURE AVAILABILITY CHARGE Fixed Charge $25.00 County General 13.47%

68-5305 MWD STANDBY EAST Fixed Charge $6.94 City General Fund 11.09%

68-4290 MORENO VALLEY FED MANDATED NPDES Fixed Charge $420.53

68-4285 MV LMD 2014-02 LANDSCAPE Fixed Charge $188.88 Total 100.00%

68-4274 MORENO VALLEY CS ZN C Fixed Charge $9.00

68-4272 MV LMD 2014-01 LIGHTING Fixed Charge $23.00

68-4271 MORENO VALLEY CS ZNA Fixed Charge $87.50 Property Tax

68-3807 CFD 2004-6 ZN1 MORENO VLY USD Fixed Charge $3,383.14

68-2491 CFD 1 NEIGHBOR PK MNT MO VLY Fixed Charge $217.96 Taxable Assessed Value $554,910

68-1860 CSA 152-MORENO VLY STORMWATER Fixed Charge $8.14 General Purpose Property Tax 1.00%

68-1377 FLD CNTL STORMWATER/CLEANWATER Fixed Charge $3.74 Other Taxes 0.12346%

Totals 1.12 6 $ ,6 . Fixed Charges $4,374

Total Property Taxes $10,608

// . . / / . .

Distribution of General Purpose

Property Tax

County, Education. Other (88.91%) $4,934

City (11.09%) $615

Total Dist. of General Purpose Property Tax $5,549

Persons per Household Density 4.2

Tax Per Household Density $14

Citizens’ Guide | 10